ABD - Yaban Mersini ve Kızılcık - Pazar Analizi, Tahmin, Boyut, Eğilimler ve Öngörüler

IndexBox Platformunda 2 milyondan fazla rapora, panoya ve veri setine anında erişim elde edin.

Fiyatlandırmayı GörüntüleU.S.: Blueberry And Cranberry Market 2022

Blueberry And Cranberry Market Size in the U.S.

The U.S. blueberry and cranberry market shrank to $X in 2021, with a decrease of -X% against the previous year. The market value increased at an average annual rate of +X% over the period from 2012 to 2021; the trend pattern indicated some noticeable fluctuations being recorded throughout the analyzed period. As a result, consumption attained the peak level of $X. From 2019 to 2021, the growth of the market remained at a somewhat lower figure.

Blueberry And Cranberry Production in the U.S.

In value terms, blueberry and cranberry production contracted to $X in 2021. The total output value increased at an average annual rate of +X% from 2012 to 2021; the trend pattern indicated some noticeable fluctuations being recorded in certain years. The most prominent rate of growth was recorded in 2018 when the production volume increased by X%. As a result, production reached the peak level of $X. From 2019 to 2021, production growth failed to regain momentum.

The average yield of blueberries and cranberries in the United States declined to X tons per ha in 2021, approximately equating 2020 figures. In general, the yield saw a relatively flat trend pattern. The growth pace was the most rapid in 2013 when the yield increased by X%. As a result, the yield attained the peak level of X tons per ha. From 2014 to 2021, the growth of the average blueberry and cranberry yield remained at a somewhat lower figure. Despite the increased use of modern agricultural techniques and methods, future yield figures may still be impacted by adverse weather conditions.

In 2021, the total area harvested in terms of blueberries and cranberries production in the United States rose to X ha, surging by X% on 2020 figures. The harvested area increased at an average annual rate of +X% over the period from 2012 to 2021; the trend pattern remained relatively stable, with only minor fluctuations being observed throughout the analyzed period. The growth pace was the most rapid in 2018 when the harvested area increased by X%. As a result, the harvested area attained the peak level of X ha. From 2019 to 2021, the growth of the blueberry and cranberry harvested area remained at a somewhat lower figure.

Blueberry And Cranberry Exports

Exports from the U.S.

In 2021, approx. X tons of blueberries and cranberries were exported from the United States; rising by X% against 2020 figures. Overall, total exports indicated mild growth from 2012 to 2021: its volume increased at an average annual rate of +X% over the last nine years. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. Based on 2021 figures, exports increased by +X% against 2018 indices. The pace of growth appeared the most rapid in 2019 when exports increased by X% against the previous year. The exports peaked in 2021 and are likely to see steady growth in the immediate term.

In value terms, blueberry and cranberry exports skyrocketed to $X in 2021. In general, total exports indicated a temperate expansion from 2012 to 2021: its value increased at an average annual rate of +X% over the last nine years. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. Based on 2021 figures, exports increased by +X% against 2015 indices. As a result, the exports reached the peak and are likely to continue growth in the immediate term.

Exports by Country

Canada (X tons) was the main destination for blueberry and cranberry exports from the United States, with a X% share of total exports. It was followed by the Netherlands (X tons), with a X% share of total exports.

From 2012 to 2021, the average annual rate of growth in terms of volume to Canada amounted to +X%.

In value terms, Canada ($X) remains the key foreign market for blueberry and cranberry exports from the United States, comprising X% of total exports. The second position in the ranking was taken by the Netherlands ($X), with a X% share of total exports.

From 2012 to 2021, the average annual rate of growth in terms of value to Canada amounted to +X%.

Export Prices by Country

In 2021, the average blueberry and cranberry export price amounted to $X per ton, which is down by -X% against the previous year. Overall, the export price, however, saw a relatively flat trend pattern. The most prominent rate of growth was recorded in 2018 when the average export price increased by X% against the previous year. As a result, the export price attained the peak level of $X per ton. From 2019 to 2021, the the average export prices remained at a lower figure.

There were significant differences in the average prices for the major external markets. In 2021, the country with the highest price was Canada ($X per ton), while the average price for exports to the Netherlands amounted to $X per ton.

From 2012 to 2021, the most notable rate of growth in terms of prices was recorded for supplies to Canada (+X%).

Blueberry And Cranberry Imports

Imports into the U.S.

For the fourth consecutive year, the United States recorded growth in overseas purchases of blueberries and cranberries, which increased by X% to X tons in 2021. Over the period under review, total imports indicated a prominent expansion from 2012 to 2021: its volume increased at an average annual rate of +X% over the last nine years. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. Based on 2021 figures, imports increased by +X% against 2012 indices. The pace of growth appeared the most rapid in 2018 when imports increased by X%. Over the period under review, imports hit record highs in 2021 and are likely to see gradual growth in the immediate term.

In value terms, blueberry and cranberry imports surged to $X in 2021. Overall, imports showed a buoyant expansion. The most prominent rate of growth was recorded in 2018 when imports increased by X% against the previous year. Over the period under review, imports reached the maximum in 2021 and are likely to see gradual growth in years to come.

Imports by Country

Peru (X tons), Canada (X tons) and Mexico (X tons) were the main suppliers of blueberry and cranberry imports to the United States, together comprising X% of total imports.

From 2012 to 2021, the biggest increases were in Peru (with a CAGR of +X%), while purchases for the other leaders experienced more modest paces of growth.

In value terms, the largest blueberry and cranberry suppliers to the United States were Peru ($X), Mexico ($X) and Chile ($X), together accounting for X% of total imports.

Peru, with a CAGR of +X%, saw the highest growth rate of the value of imports, in terms of the main suppliers over the period under review, while purchases for the other leaders experienced more modest paces of growth.

Import Prices by Country

The average blueberry and cranberry import price stood at $X per ton in 2021, surging by X% against the previous year. Over the last nine years, it increased at an average annual rate of +X%. The import price peaked at $X per ton in 2019; however, from 2020 to 2021, import prices remained at a lower figure.

There were significant differences in the average prices amongst the major supplying countries. In 2021, the country with the highest price was Mexico ($X per ton), while the price for Canada ($X per ton) was amongst the lowest.

From 2012 to 2021, the most notable rate of growth in terms of prices was attained by Chile (+X%), while the prices for the other major suppliers experienced mixed trend patterns.

Kaynak: IndexBox Platformu

Sık Sorulan Sorular (SSS) :

Bu rapor, ABD'deki yaban mersini ve kızılcık pazarının derinlemesine bir analizini sunar. İçinde, ülke, tüketim, üretim ve fiyat gelişmelerinin yanı sıra küresel ticarete (ithalat ve ihracat) göre pazar eğilimleri ve fırsatları hakkında en son verileri keşfedeceksiniz. Tahmin, 2030 yılına kadar pazar beklentilerini gösteriyor.

Ürün kapsamı:

- FCL 552 - Yaban mersini

- FCL 554 - Kızılcık

Ülke kapsamı:

- United States

Veri kapsamı:

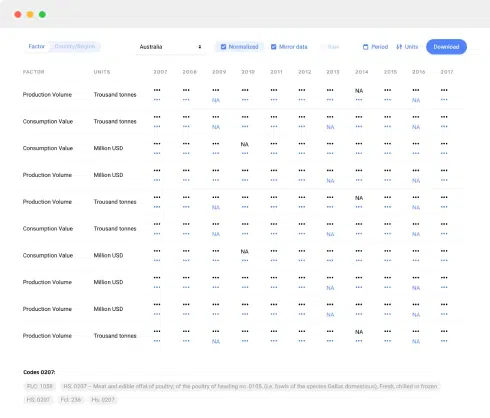

- Pazar hacmi ve değeri

- Kişi Başına Tüketim

- Orta vadede piyasa dinamiklerinin tahmini

- ABD'de ticaret (ihracat ve ithalat)

- İhracat ve ithalat fiyatları

- Pazar eğilimleri, itici güçler ve kısıtlamalar

- Önemli piyasa oyuncuları ve profilleri

Bu raporu satın alma nedenleri:

- En son verilerden yararlanın

- Mevcut pazar gelişmeleri hakkında daha derin bilgiler bulun

- Piyasayı etkileyen hayati başarı faktörlerini keşfedin

Bu rapor, üreticiler, distribütörler, ithalatçılar ve toptancılar ile yatırımcılar, danışmanlar ve danışmanlar için tasarlanmıştır.

Bu raporda, aşağıdaki konularda bilinçli kararlar vermenize yardımcı olacak bilgileri bulabilirsiniz:

- İşinizi nasıl çeşitlendirirsiniz ve yeni pazar fırsatlarından nasıl yararlanırsınız?

- Atıl üretim kapasitenizi nasıl yüklersiniz?

- Yurtdışı pazarlarda satışlarınızı nasıl artırabilirsiniz?

- Kar marjlarınızı nasıl artırabilirsiniz?

- Tedarik zincirinizi nasıl daha sürdürülebilir hale getirirsiniz?

- Üretim ve tedarik zinciri maliyetlerinizi nasıl azaltabilirsiniz?

- Üretimi diğer ülkelere nasıl taşeronlaştırabilirim?

- İşletmenizi küresel genişlemeye nasıl hazırlarsınız?

Bu araştırmayı yaparken analistlerimizin birikmiş uzmanlığı ile yapay zekanın yeteneklerini birleştiriyoruz. Veri bilimcilerimiz tarafından geliştirilen yapay zeka tabanlı platform, iş analistleri için temel çalışma aracını oluşturarak pazarlama verilerinden derin içgörüler ve fikirler keşfetmelerini sağlar.

-

1. GİRİİŞ

İşinizi Büyütmek için Veriye Dayalı Kararlar Verme

- RAPOR AÇIKLAMASI

- ARAŞTIRMA METODOLOJİSİ VE AI PLATFORMU

- İŞİNİZ İÇİN VERİ ODAKLI KARARLAR

- SÖZLÜK VE ÖZEL TERİMLER

-

2. YÖNETİCİ ÖZETİ

Piyasa Performansına Hızlı Bir Bakış

- ÖNEMLİ BULGULAR

- PAZAR EĞİLİMLERİ Bu Bölüm Yalnızca Profesyonel Sürüm için Mevcuttur PRO

-

3. PİYASA BAKIŞ

Piyasanın Mevcut Durumunu ve Beklentilerini Anlamak

- MARKET BOYU

- PAZAR YAPISI

- TİCARET DENGESİ

- KİŞİ BAŞINA TÜKETİM

- 2030 İÇİN PİYASA TAHMİNİ

-

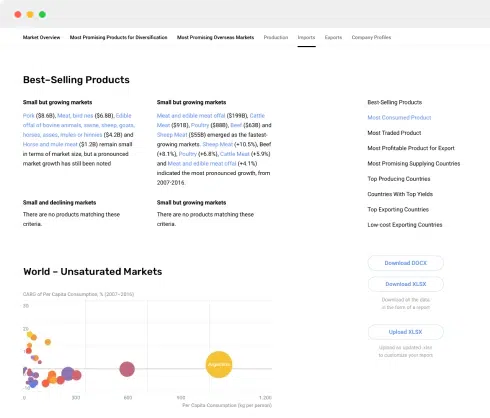

4. EN ÖNEMLİ ÜRÜN

İşinizi Çeşitlendirmek için Yeni Ürünler Bulma

Bu Bölüm Yalnızca Profesyonel Sürüm için Mevcuttur PRO- İŞİNİZİ ÇEŞİTLENDİRMEK İÇİN EN İYİ ÜRÜNLER

- EN ÇOK SATAN ÜRÜNLER

- EN ÇOK TÜKETİLEN ÜRÜN

- EN ÇOK İŞLEM YAPILAN ÜRÜN

- İHRACAT İÇİN EN KARLI ÜRÜN

-

5. EN ÜMIT VADEDEN TEDARİKÇİ ÜLKELER

Sürdürülebilir Tedarik Zincirinizi Kurmak İçin En İyi Ülkeleri Seçmek

Bu Bölüm Yalnızca Profesyonel Sürüm için Mevcuttur PRO- ÜRÜNÜNÜZÜN KAYNAKLANMASI İÇİN EN İYİ ÜLKELER

- TOP PRODUCING COUNTRIES

- EN ÇOK ÜRETİCİ ÜLKELER

- EN ÇOK İHRACAT YAPAN ÜLKELER

- DÜŞÜK MALİYETLİ İHRACAT YAPAN ÜLKELER

-

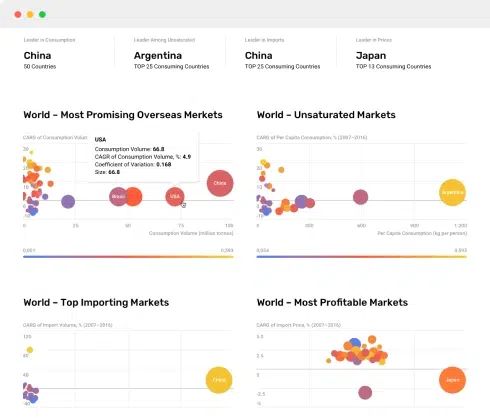

6. EN ÖNEMLİ YURTDIŞI PAZARLAR

İhracatınızı Artıracak En İyi Ülkeleri Seçmek

Bu Bölüm Yalnızca Profesyonel Sürüm için Mevcuttur PRO- ÜRÜNÜNÜZÜ İHRACAT İÇİN EN İYİ YURTDIŞI PAZARLAR

- EN ÇOK TÜKETİCİ PAZARLAR

- DOYMUŞMAMIŞ PAZARLAR

- EN İYİ İTHALAT PAZARLARI

- EN KARLI PAZARLAR

7. ÜRETME

Sektöre İlişkin Son Trendler ve Görüşler

- ÜRETİM, HASAT ALAN VE VERİM

8. İTHALAT

En Büyük İthalat Sağlayan Ülkeler

- 2012-2023 İTHALAT

- ÜLKEYE GÖRE İTHALAT

- ÜLKEYE GÖRE İTHALAT FİYATLARI

9. İHRACAT

İhracat için En Büyük Destinasyonlar

- 2012-2023 İHRACATLARI

- ÜLKEYE GÖRE İHRACAT

- ÜLKEYE GÖRE İHRACAT FİYATLARI

-

10. BAŞLICA ÜRETİCİLERİN PROFİLLERİ

Piyasadaki En Büyük Üreticiler ve Profilleri

Bu Bölüm Yalnızca Profesyonel Sürüm için Mevcuttur PRO -

TABLO LİSTESİ

- 2023'de Önemli Bulgular

- Fiziki Olarak Pazar Hacmi, 2012–2023

- Piyasa Değeri, 2012–2023

- 2012-2023 Yılı Kişi Başına Tüketim

- İthalat, Fiziksel Olarak, Ülkeye Göre, 2012–2023

- İthalat, Değer Bazında, Ülkeye Göre, 2012–2023

- Menşe Ülkeye Göre İthalat Fiyatları, 2012-2023

- İhracat, Fiziki Olarak, Ülkeye Göre, 2012–2023

- İhracat, Değer Bazında, Ülkeye Göre, 2012–2023

- Hedef Ülkeye Göre İhracat Fiyatları, 2012–2023

-

ŞEKİLLER LİSTESİ

- Fiziki Olarak Pazar Hacmi, 2012–2023

- Piyasa Değeri, 2012–2023

- Piyasa Yapısı – Yurtiçi Arz ve İthalat, Fiziki Açıdan, 2012-2023

- Piyasa Yapısı – Yurt İçi Arz ve İthalat, Değer Açısından, 2012-2023

- Fiziki Açıdan Ticaret Dengesi, 2012-2023

- Ticaret Dengesi, Değer Açısından, 2012-2023

- Kişi Başına Tüketim, 2012-2023

- 2030 Pazar Hacmi Tahmini

- 2030'a Kadar Piyasa Değeri Tahmini

- Ürünler: Türe Göre Pazar Büyüklüğü ve Büyüme

- Ürünler: Türe Göre Kişi Başına Ortalama Tüketim

- Ürünler: Türüne Göre İhracat ve Büyüme

- Ürünler: Türe Göre İhracat Fiyatları ve Büyüme

- Üretim Hacmi ve Büyüme

- Verim ve Büyüme

- İhracat ve Büyüme

- İhracat Fiyatları ve Büyüme

- Pazar Büyüklüğü ve Büyüme

- Kişi Başına Tüketim

- İthalat ve Büyüme

- İthalat Fiyatları

- Üretim, Fiziksel Olarak, 2012–2023

- Üretim, Değer Açısından, 2012–2023

- Hasat Edilen Alan, 2012–2023

- Verim, 2012-2023

- İthalat, Fiziki Açıdan, 2012–2023

- İthalat, Değer Açısından, 2012–2023

- İthalat, Fiziki Olarak, Ülkeye Göre, 2023

- İthalat, Fiziksel Olarak, Ülkeye Göre, 2012–2023

- İthalat, Değer Bazında, Ülkeye Göre, 2012–2023

- Menşe Ülkeye Göre İthalat Fiyatları, 2012-2023

- Fiziksel Olarak İhracat, 2012–2023

- Değer Bazında İhracat, 2012–2023

- İhracat, Fiziki Olarak, Ülkeye Göre, 2023

- İhracat, Fiziki Olarak, Ülkeye Göre, 2012–2023

- İhracat, Değer Bazında, Ülkeye Göre, 2012–2023

- Hedef Ülkeye Göre İhracat Fiyatları, 2012–2023

Önerilen raporlar

Bu rapor, Asya'daki yaban mersini ve kızılcık pazarının derinlemesine bir analizini sunar.

Bu rapor, Çin'deki yaban mersini ve kızılcık pazarının derinlemesine bir analizini sunar.

Bu rapor, AB'deki yaban mersini ve kızılcık pazarının derinlemesine bir analizini sunar.

Bu rapor, küresel yaban mersini ve kızılcık pazarının derinlemesine bir analizini sunar.